What Is Unit Trust

With the experience skills and resources to manage the.

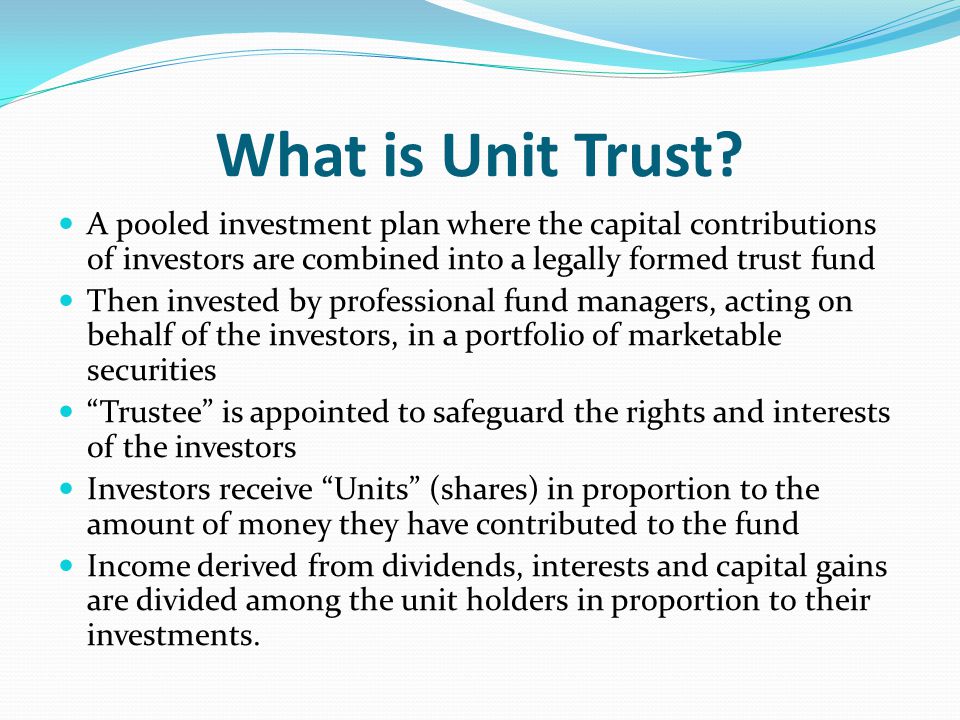

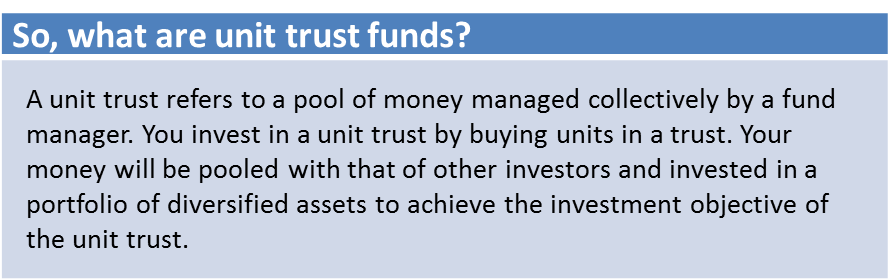

What is unit trust. Unit trusts are unincorporated mutual funds that pass profits directly to investors rather than reinvesting in the fund. A unit is a piece of property that entitles the unit holder to a specified proportion of the income and capital of the trust. How does a unit trust work. Unit trusts versus ilps investment linked insurance policies ilps are another way to invest in funds.

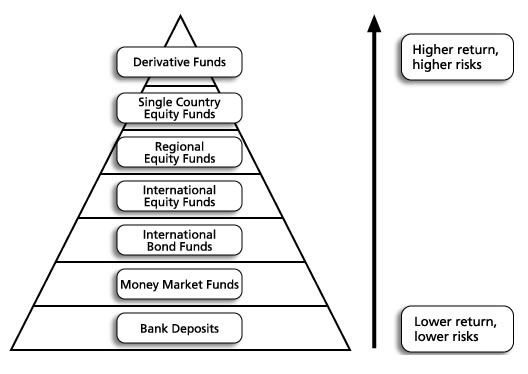

Unit trusts offer access to a wide range of investments and depending on the trust it may invest in securities such as shares bonds gilts and also properties mortgage and cash equivalents. In this guide the term fund will also refer to a unit trust. You buy units with the investment you make in a unit trust. If you would like to enjoy the benefit of diversification with unit trusts investment you can invest a lump sum amount or set up a monthly investment plan.

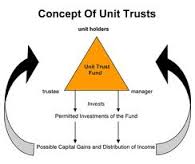

Not all funds use a trust structure. Unit trusts enable investors to diversify their investments into different markets and investment instruments such as equities bonds securities currencies and warrants derivatives. The performance of any unit trust also depends on the expertise and investment decisions of its fund managers. A unit trust is composed of a pool of monies from a group of investors managed by a fund manager who then invests it in a variety of financial assets.

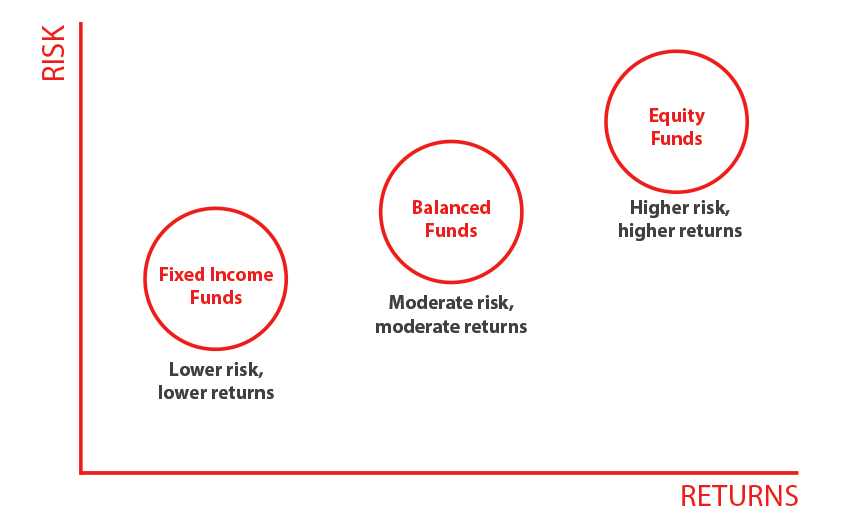

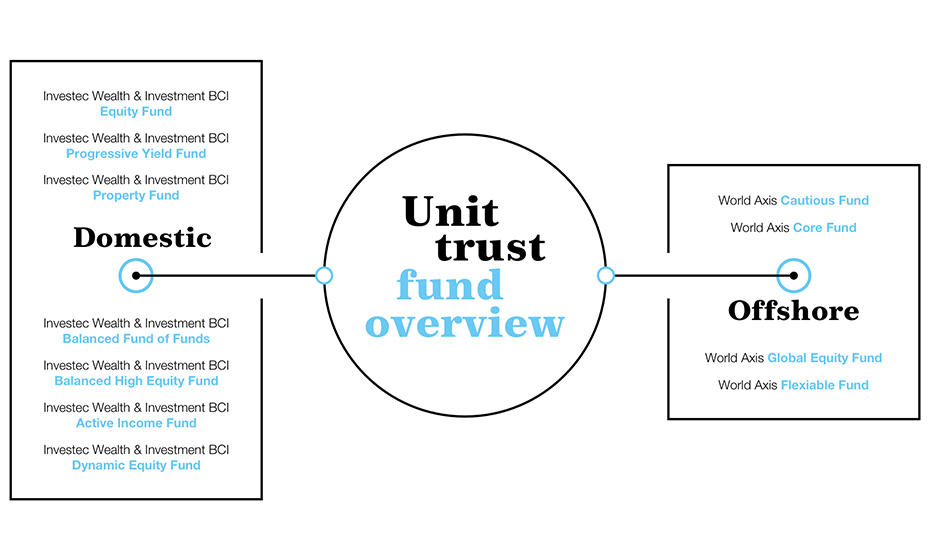

Unit trusts are typically classified by geography sector and type of assets held. A fund house s fund name would reflect these. A unit trust is an open ended grouped investment product which means there is no limit to how many people can invest in it or how much can be invested. It is important to choose one that best matches your investment objectives and risk profile.

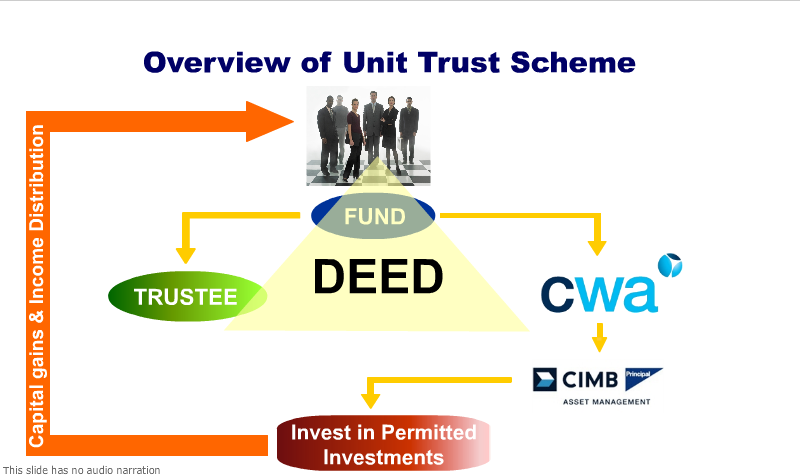

A unit trust is a form of collective investment constituted under a trust deed. A unit trust pools investors money into a single fund which is managed by a fund manager. Unit trusts are also subject to a lesser level of regulation meaning that the trust s financial results may remain confidential and its accounts do not need to be audited. A unit trust is a fund which adopts a trust structure.

The investor is the trust s beneficiary. For example if a fund name reads yellow pebble asia energy equity fund this means that the fund is managed by a fund house called yellow pebble which invests in equity stocks of companies in the energy sector that are listed in asia.