Types Of Taxes In Malaysia

Everyone working in malaysia is required to pay income tax and all types of incomes are taxable including gains from business activities and dividends.

Types of taxes in malaysia. Personal income tax 2 personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. In malaysia for a period of less than 182 days during the year shorter. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst.

In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. This is somewhere between sole proprietorship and private limited. In malaysia for at least 182 days in a calendar year.

Service excellence innovation or productivity award. Exemption available up to rm2 000 per annum for the following types of award long service more than 10 years of employment with the same employer past achievement. The income tax exemption no. 22 order 2007 2007 exemption order due to the terminology used which refers to offshore company instead of labuan entity labuan companies and labuan trusts are amongst the types of entities specified as being exempted from withholding tax on interest royalties and technical fees paid to non residents.

Income tax borne by employer. What supplies are liable to the standard rate. 10 for sales tax and 6 for service tax. The companies commission of malaysia has only quite recently introduced this option to malaysian entrepreneurs in 2013 so one immediate disadvantage is how local banks are still new to the idea of limited liability companies and setting up a bank account for it might be a bit troublesome.

This order exempts a person not resident in malaysia from income tax payment in respect of income falling under section 4a i and ii of the ita 1967 where services are rendered and performed outside malaysia. Under the income tax exemption no. Ptptn loan repayment. Total amount paid by employer.

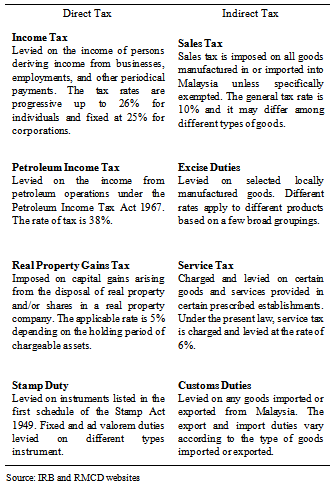

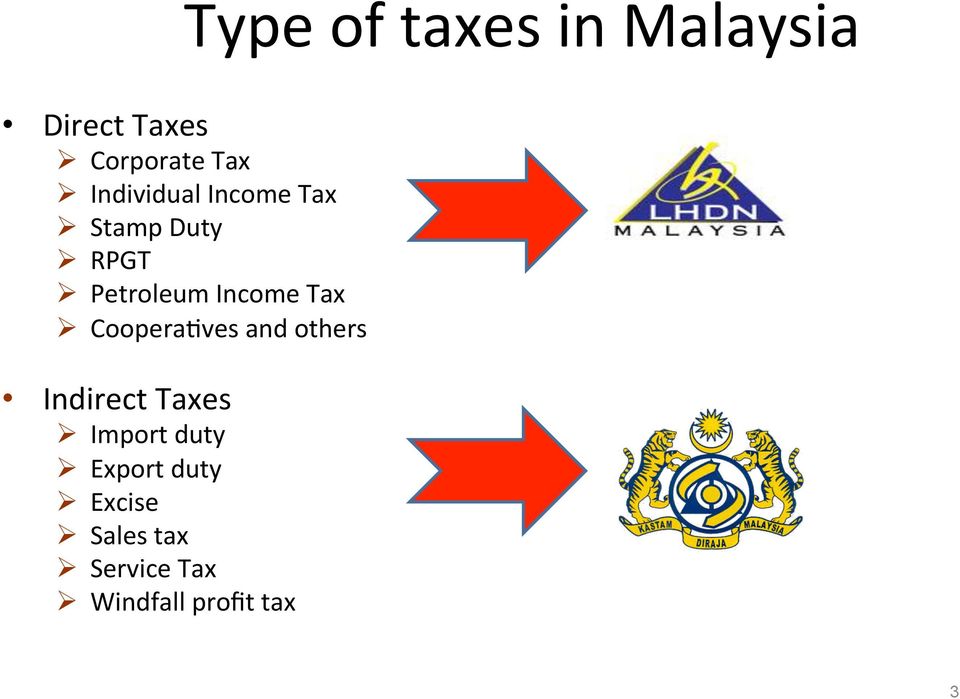

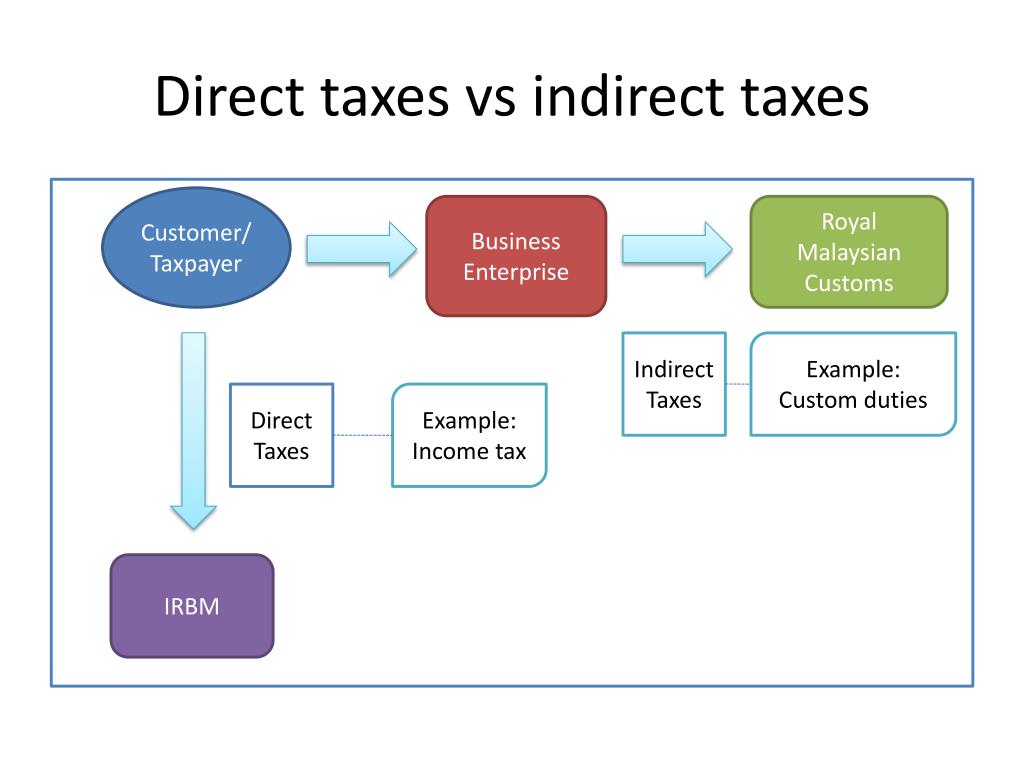

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. 9 order 2017 p u a 323 was gazetted on 24 october 2017. Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment. Type of indirect tax.