Type Of Allowance For Employees In Malaysia

Malaysia salary guide year 2020.

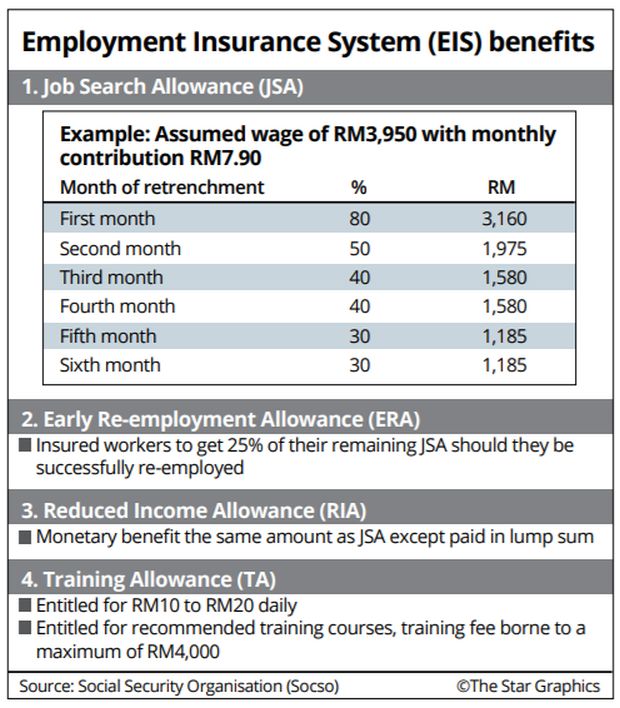

Type of allowance for employees in malaysia. In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. Dearness allowance da is an allowance paid to employees as a cost of living adjustment allowance. A service provider with ssm registered and not your employee. Job search allowance jsa a financial allowance for those who have lost their one and only job.

2020 malaysia benefits summary. Employees of regional operations. Petrol allowance petrol card travelling allowance or toll payment or any combination. The most prefer are big companies like mnc and etc below is just an example.

If the amount received exceeds rm6 000 a year the employee can make a further deduction in respect of the amount spent for official duties. Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. Employees are eligible for most benefits programs on the first day of employment. Here are the 14 tax exempt allowances gifts benefits perquisites.

If a female employee after giving notice to her employer that she expects to be confined commences her maternity leave and dies from any cause during the eligible period her employer or any employer who would have been but for the death of the female employee liable to pay any maternity allowance shall pay to the person nominated by her under section 41 or if there is no such person to. Payment rates will be based on the assumed monthly wages in table 2. The 5 types of monetary benefits are. Salary guide for year 2020.

Non malaysian citizens who are based in malaysia working in operational headquarter ohq or regional office ro or international procurement centre ipc or regional distribution centre rdc or treasury management centre tmc status companies would be taxable on employment income attributable to the number of days they exercise employment in malaysia. Hi all i am just curious to compile as many malaysian employer benefits as possible to share with everyone this is to benefit all jobs hunter and those who are interested to know how your company compare to others i hope anyone out there would help me to build up this list. Employees shall be granted 12 vacation days on a prorated basis for less than 2 years of service. Da is fully taxable with salary.

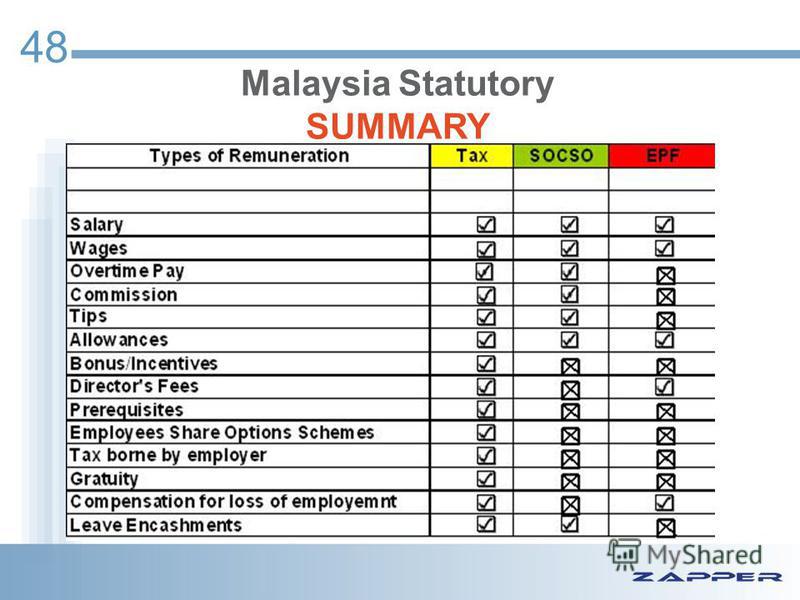

Benefits in kind are also a type of benefit received by employees which are not included in their salary such as cars furniture and personal drivers. Minimum salary for malaysia in year 2020 is rm 1 200 00. The allowance is paid to the employees to manage the inflation. A perquisite is a perk or benefit given to you by your employer like travel and medical allowances.