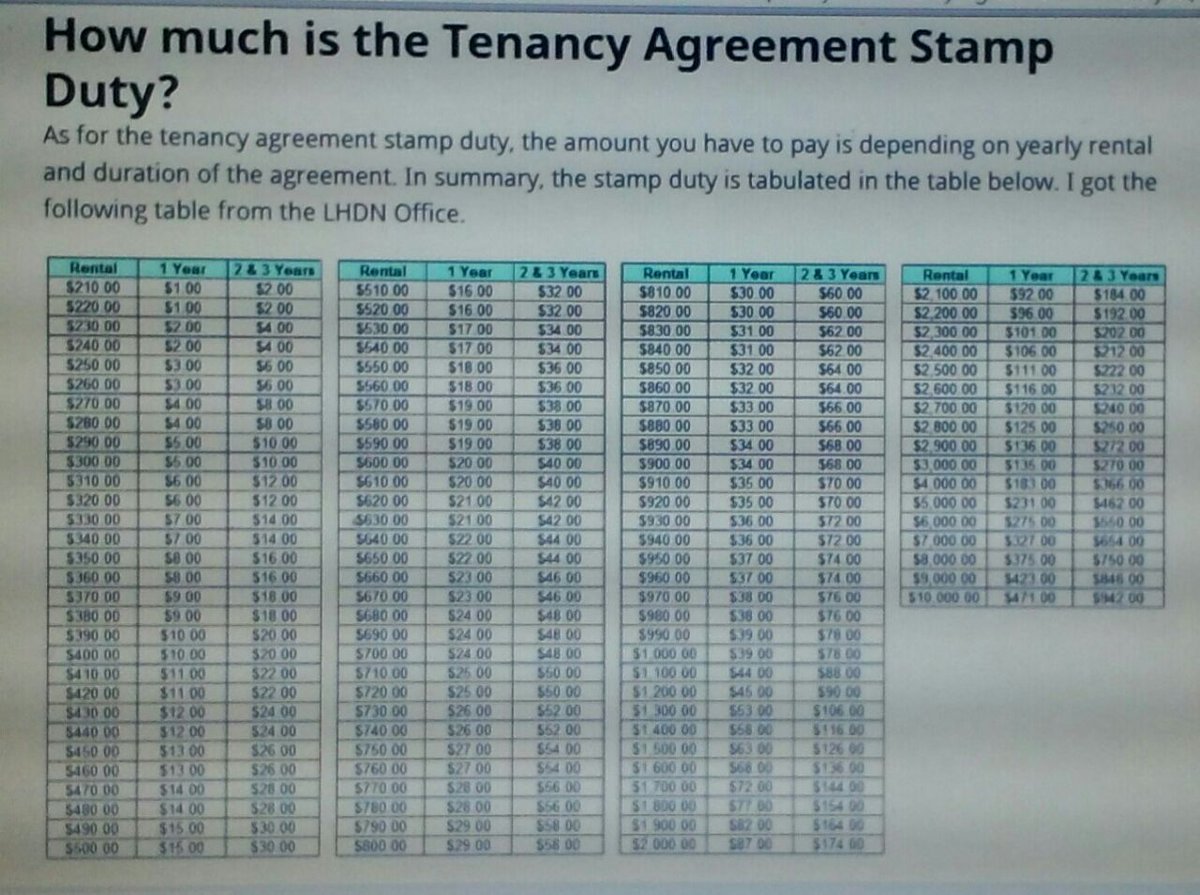

Tenancy Agreement Stamp Duty Table

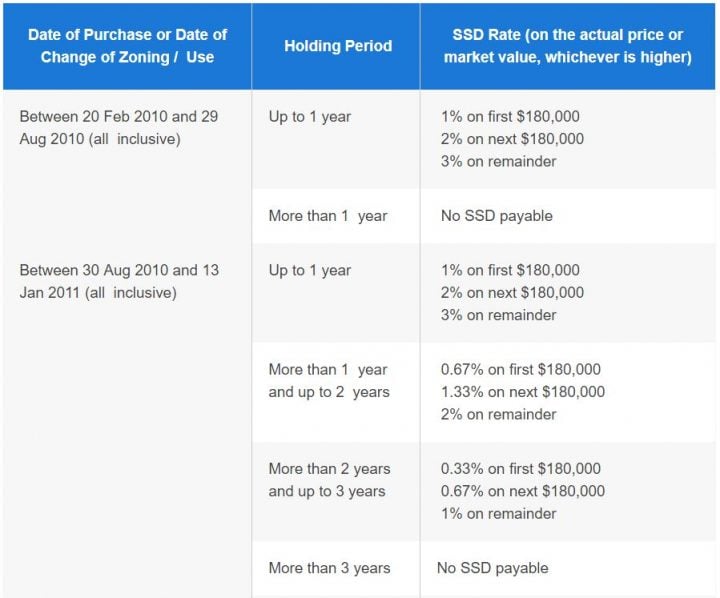

The sdlt threshold was raised in march 2005 to 120 000 and in march 2006 to 125 000.

Tenancy agreement stamp duty table. Subject to the conditions set out in section 45 of the stamp duty ordinance the ordinance stamp duty relief is available for the transfer of immovable property or shares from one associated body corporate to another. Enter the monthly rental duration number of additional copies to be stamped. Calculate the taxable rental. To use this calculator.

Online calculator to calculate tenancy agreement stamp duty. Stamp duty on tenancy agreement our public notice on tenancy agreement captured only the last band which is 6 per cent it does not mean that it has a flat rate of 6 per cent. How much is the tenancy agreement stamp duty. Sdlt is a tax levied on tenancy transactions paid by tenants and is calculated on the amount of gross rent for the term of the tenancy less a pre set discount temporal discount rate currently 3 5.

All you need is a registered account with us. As the first rm2 400 is exempted from stamp duty the taxable rental amount would be rm12 000 rm14 400 rm2 400. Please input the tenancy details and then press compute. It was a publication.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Stamp duty relief. Registered account if you perform e stamping frequently you may wish to sign up as a corppass user and enjoy additional features. The stamp duty would be charged according to the duration of the tenancy refer to table above.

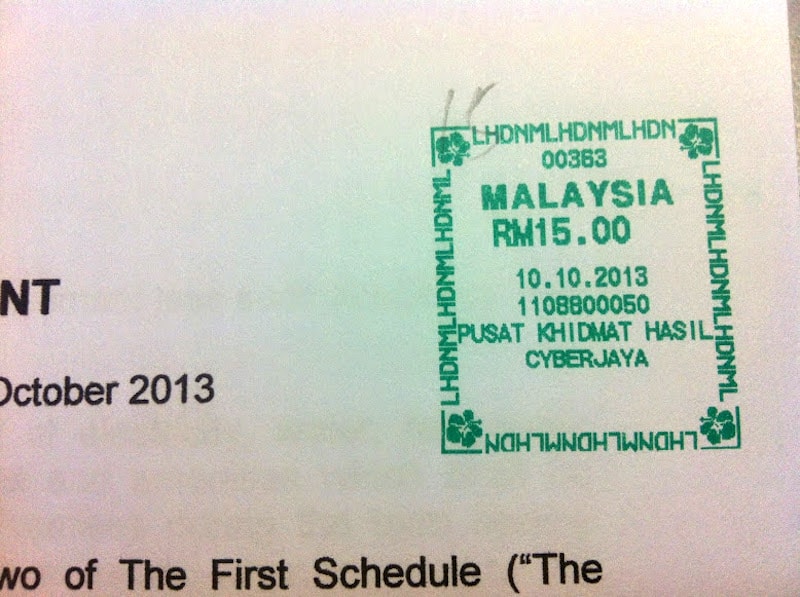

Tenancy agreement table of contents login with singpass page 2 3 fill in the lease tenancy e stamping form page 4 6 preview and declare page 7 payment page 8 12 glossary page 13 16 june 2020 inlmasc hwta 1 1 complete e stamping form 2 pay stamp duty 3 download stamp certificate complete e stamping in 3 stages. For second copy of tenancy agreement the stamping cost is rm10. I got the following table from the lhdn office. The amount of the current stamp duty payable is computed according to the information that you have entered.

Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. Step 1 1 login read. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130.