Tax Slabs Personal Income Tax Rate In Bangladesh 2020 21

50 lakhs to rs.

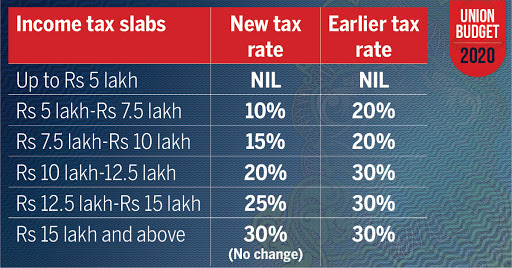

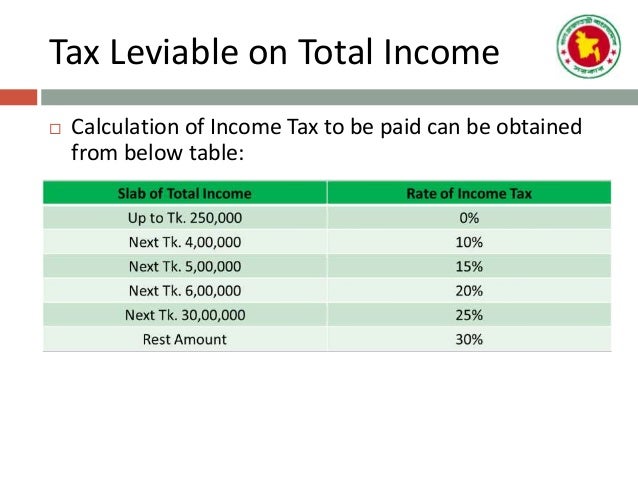

Tax slabs personal income tax rate in bangladesh 2020 21. New income tax slab 2020 21 vs old income tax slab 2019 20. Existing income tax slabs for fy 2020 21 alternative the income earned individuals will determine the income tax slabs under which they fall. The tax free income limit for individual taxpayer has been increased in the proposed budget for fy 2020 21. The figures mentioned above are indicative.

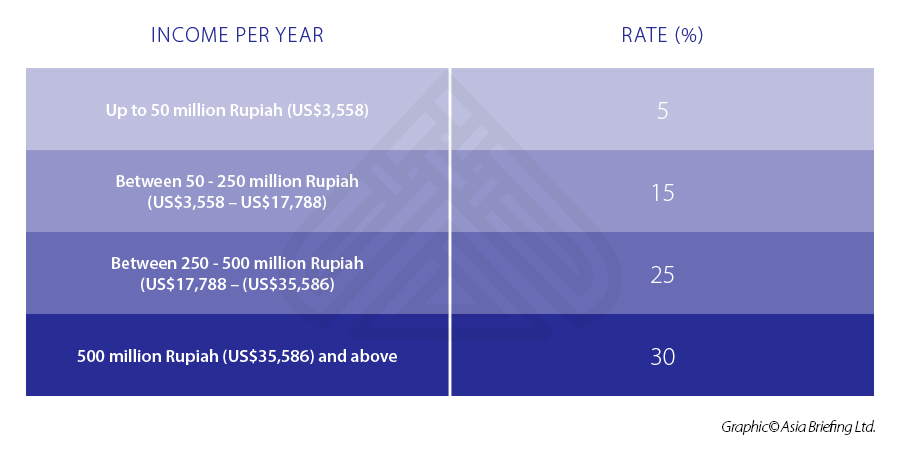

Here are the income tax slab rates for the financial year 2019 20 relevant to assessment year 2020 21 for resident individual below 60 years old huf and aop boi artificial juridical person senior citizens 60 years or more but less than 80 years senior citizens 80 years or more. 2020 special tax rate for individual and hufs. For the purpose of ascertainment of the applicable tax slab an individual can be classified as follows. Given below are the latest income tax slabs and rates applicable for the financial year 2019 20 and 2020 21.

The finance minister has introduced many changes in the income tax slab rate for financial year 2019 2020 ay 2020 2021. Depending on the age of the individual the three. 22 775 plus 37c for each 1 over 90 000. Tax payers can choose either new tax slab or old income tax slab for assessing the income tax for financial year 2020 2021.

15c for each 1. In this article we update you about the income tax slab rates applicable to different types of taxpayers such as individual huf partnership firms aop boi co operative society local authorities domestic as well as foreign companies etc for assessment year 2020 21 i e. Assessment year 2021 22 assessment year 2020 21 range of income range of income rs. 56 075 plus 45c for each 1 over 180 000.

Working holiday maker tax rates 2020 21. 5 550 plus 32 5c for each 1 over 37 000. Income tax slab rates are decided and governed by income tax act 1961 and are subject to change every year. Income tax slabs for fy 2020 21 ay 2021 22 leave a comment budget budget 2020 capital gain tax income tax investment plan taxes by amit february 3 2020 february 3 2020 your income from salary business or other income like income from fixed recurring deposits etc are taxed as per income tax slabs.

Tax on this income. In the new budget the tax free income limit has been fixed at tk 300 000. 1 crore to rs. These rates are optional.

For the financial year 2020 21 a new tax regime with concessional tax rates has been introduced. Some of the highlights of income tax slab rates for fy 2019 20 assessment year 2020 21 income tax slab rates help you decide whether your income is taxable or not. It is optional for any individual to choose either new income tax slab 2020 21 or old income tax slab 2019 20.

-20190201043639.png)